CRREM Is the Vision. We Bridge the Execution Gap

CRREM Is the Vision. We Bridge the Execution Gap

We translate long-term sustainability targets into measurable, cost-effective energy action—building by building.

We translate long-term sustainability targets into measurable, cost-effective energy action—building by building.

- Which assets are “stranded”, at risk of failing future carbon regulations,

- Where to act with energy-efficient renovations,

- How to preserve and enhance your asset’s market value in a climate-conscious economy.

dEEP Action Plan helps you to achieve your CRREM targets

dEEP Action Plan helps you to achieve your CRREM targets

CRREM is the tool that tells you if your building is OK—or if it’s heading toward a loss in value due to poor energy performance

CRREM is the tool that tells you if your building is OK—or if it’s heading toward a loss in value due to poor energy performance

If it’s not aligned, that’s the warning sign: you need to take action, either through strategic renovations or by implementing smart tools like dEEP by dnergy®.

If it’s not aligned, that’s the warning sign: you need to take action, either through strategic renovations or by implementing smart tools like dEEP by dnergy®.

- Dynamically track carbon performance per asset in real time

- Simulate future compliance scenarios using CRREM trajectories

- Identify where and when to invest in targeted improvements

- Reduce carbon intensity—and prove it, with live data

- Dynamically track carbon performance per asset in real time

- Simulate future compliance scenarios using CRREM trajectories

- Identify where and when to invest in targeted improvements

- Reduce carbon intensity—and prove it, with live data

dEEP contributes to compliance at every step

dEEP contributes to compliance at every step

Unified data to improve reporting towards EU compliance

Unified data to improve reporting towards EU compliance

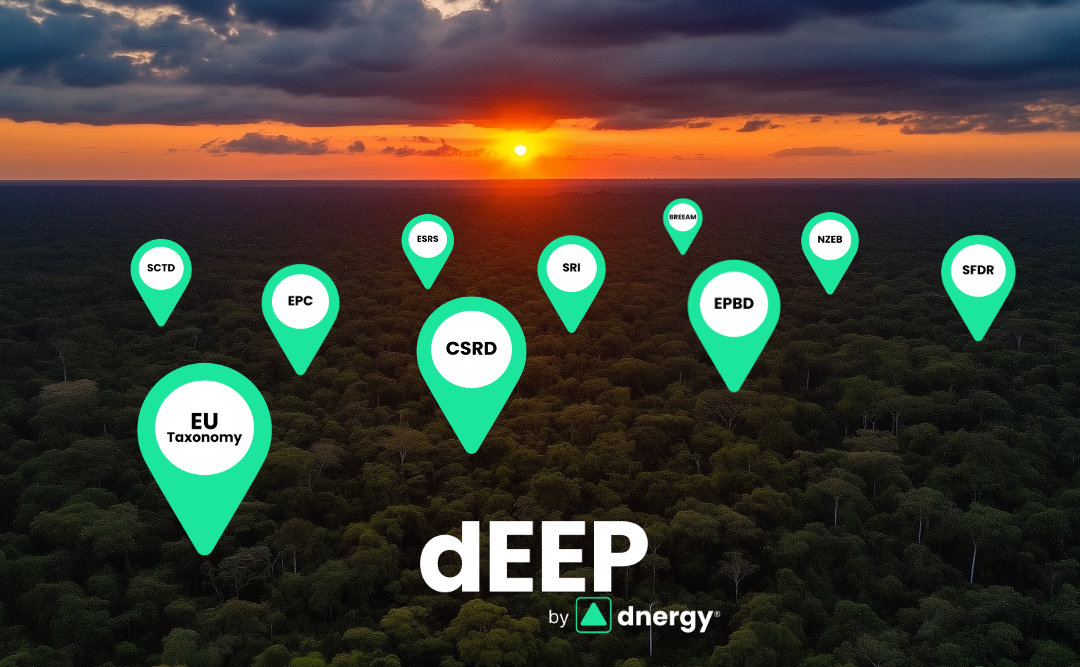

A regulatory jungle

A regulatory jungle

Forest and Trees – Navigating the Regulatory and Compliance Jungle

Compliance, every step of the way—with dEEP

Forest and Trees – Navigating the Regulatory and Compliance Jungle

Compliance, every step of the way—with dEEP

In a rapidly shifting regulatory landscape, real estate portfolio asset managers face growing demands for sustainability transparency, energy efficiency, and ESG accountability. Europe’s key regulations – from the EU Taxonomy to the EPBD – require a unified, data-driven approach to stay compliant and competitive.

dEEP, the AI-driven compliance platform from dnergy®, helps you understand, implement, and report across all significant sustainability regulations impacting your portfolio. Whether you're navigating ESG disclosures, energy certifications, or investor benchmarks, dEEP transforms scattered data into actionable compliance intelligence.

Stay Compliant & Competitive:

What You Need to Know About Europe’s 8 Key Energy & Sustainability Regulations.

Stay Compliant & Competitive:

What You Need to Know About Europe’s 8 Key Energy & Sustainability Regulations.

EU Taxonomy (European Union Taxonomy for Sustainable Activities)

- The EU Taxonomy is a classification system that defines which economic activities can be considered environmentally sustainable. It is a cornerstone of the European Green Deal, designed to direct capital towards green investments and align financial flows with climate goals.

- This means identifying which assets and renovation activities meet strict technical screening criteria for real estate, particularly in climate change mitigation, adaptation, and energy performance. The goal is to promote transparency, reduce greenwashing, and build investor trust through standardized definitions of “sustainability.”

SFDR (Sustainability Financial Disclosure Regulation)

- The SFDR requires financial market participants, including asset managers, to disclose how sustainability risks are integrated into investment decisions and the likely impacts of these risks on returns. It’s part of the EU’s broader Sustainable Finance framework, aiming to bring more accountability and transparency to ESG claims.

- For real estate portfolios, SFDR means tracking and reporting sustainability metrics at asset and fund levels — both at pre-contractual and ongoing stages. The regulation categorizes financial products into Articles 6, 8, and 9 based on their sustainability focus, creating an urgent need for reliable data and transparent reporting mechanisms.

CSRD (Corporate Sustainability Reporting Directive)

- The CSRD builds on the Non-Financial Reporting Directive (NFRD) by dramatically expanding the scope and depth of sustainability reporting in the EU. Large companies and listed SMEs must disclose detailed, auditable information on ESG topics in line with the European Sustainability Reporting Standards (ESRS).

- Real estate asset managers must now track and report environmental impact, climate risks, social responsibility, and governance performance at both corporate and asset levels. This includes forward-looking metrics, double materiality assessments, and value chain disclosures.

EPBD (Energy Performance of Buildings Directive)

- The EPBD is central to the EU’s efforts to decarbonize its building stock, which accounts for roughly 40% of energy consumption and 36% of CO₂ emissions. It outlines requirements for energy performance certificates (EPCs), regular inspections, and long-term renovation strategies

- The 2023 revision pushes further — mandating minimum energy performance standards (MEPS) for all buildings, introducing a digital building logbook, and requiring the phase-out of fossil fuel heating. This directly impacts asset managers who must ensure their portfolios are energy-compliant and renovation-ready.

EPC (Energy Performance Certificate)

- The EPC provides a standardized rating of a building’s energy efficiency, offering crucial insight into operational performance and compliance with national energy regulations. It is a central tool in assessing current building stock and informing decisions on renovations and sustainability targets.

- For real estate asset managers, EPCs are essential for compliance, tenant transparency, and aligning with broader carbon reduction strategies. EPC ratings increasingly influence property valuations, tenant demand, and investor scrutiny.

NZEB (Nearly Zero-Energy Building)

- NZEB standards require buildings to have very high energy performance, with most of the required energy coming from renewable sources. It’s a key component of the EU’s climate-neutral building agenda, especially for new constructions and major renovations.

- Complying with NZEB is no longer optional — it’s a prerequisite for new developments and retrofits. This means precise planning, cost forecasting, and integration of on-site renewables or high-efficiency systems for asset managers.

SRI (Smart Readiness Indicator)

- The SRI is a new EU framework measuring a building’s capability to adapt its energy use via innovative technologies — such as automation, responsiveness to occupant needs, and integration with energy grids.

- SRI brings a digital dimension to sustainability. It’s about leveraging intelligence to reduce energy consumption, improve comfort, and support decarbonization. For real estate owners, it creates a future-facing value metric tied to innovation and operational efficiency.

BREEAM (Building Research Establishment Environmental Assessment Method)

- BREEAM is a globally recognized sustainability certification that assesses buildings across energy, health, water, materials, and innovation categories. A strong BREEAM rating enhances asset value, attracts ESG-conscious tenants, and reinforces investor confidence.

- Navigating BREEAM requirements across a portfolio — especially during acquisition or renovation — requires continuous tracking, data centralization, and performance optimization.

Our results

Customer's cases studies

Floor area: 9,732 m²

Savings:• Gas 36 157 kWh 4.9%• Electricity 285 666 kWh 26.8%• CO2 116 211 kg 25.7%

Value:

• Building kWh savings + CAPEX

Floor area: 10,560 m²

Savings:• Gas 793 242 kWh 50.5%• Electricity 384 784 kWh 26.9%• CO2 277 435 kg 36.5%

Value:

• Building out of comfort to back to comfort (no savings)

Floor area: 10,000 m²

Savings:• Gas 269 763 kWh 33.1%• Electricity 17 094 kWh 4.5%• CO2 66 936 kg 24.2%

Value:

• Savings + Compliance to EPBD/Plage

Floor area: 18,742 m²

Savings:• Gas 198 283 kWh 34.8%• Electricity 219 895 kWh 20.7%• CO2 130 481 kg 24.0%

Value:

• Saving from adjustments and Autopilot

Ready to discover what the Energy Efficiency Program by dnergy means for your portfolio?

by reducing your CO2 and energy cost without effort.